Fiscal Guide

This page was last updated on:

Fiscal Training

Title: Fiscal Refresh and Updates – November 15th, 2023

Overview: This webinar providers a fiscal refresh, discussions about indirect costs, and announces Fiscal Office Hours.

Documents:

– Slides: http://www.pa-home-visiting.org/wp-content/uploads/2023/11/Fiscal-Monitoring-Webinar_November-2023.pdf

Title: General Ledger Reconciliation Tutorial – August 13th, 2023

Title: Fiscal On-Site Monitoring

This webinar was presented on February 15th, 2023.

Recording:

http://www.pa-home-visiting.org/wp-content/uploads/2023/02/Fiscal-On-Site.mp4

Overview:

In this Webinar we outlined the policies and items needed for both on-going Fiscal Monitoring as well as virtual/on-site visits. The main purpose of these visits are to monitor collect and review documents to ensure allowability. We will work with each of you to make sure you have everything in place for successfully safeguarding State and Federal Grant funds.

As part of our cyclical monitoring protocol, each Family Support grantee will receive a visit throughout the contracted period. This webinar will highlight:

- The fiscal Supplement & Policy (On-Going)

- Audits (Year-End)

- GL Reconciliations (Year-End)

Documents:

– Slides: http://www.pa-home-visiting.org/wp-content/uploads/2023/02/Fiscal-Monitoring-Webinar_Feb-2023.pdf

Commonly Asked Budgeting Questions?

Disclaimer: These questions and responses are provided as a reference only and may not apply to your specific situation. Please contact your Family Support Consultant to confirm the answers provided below apply to your unique situation.

Q: Clarification is needed regarding programs use of incentives/stipends to spend down funds.

A: Parent incentives may be allowable if tied to parent engagement and is meaningful to the operation and implementation of the grant approved model. Stipends are only to be considered if you have an organizational policy that lays out the method and purpose for providing a stipend. Typically they are provided when a staff person is required to go above and beyond their normal hired duties. If programs have specific requests they should send them through individually to their Family Support Consultant.

Q: Clarification is needed regarding the use of funds to send home visitors to the national conferences in future grant years.

A: Generally, Airfare and Conference Registration charge immediately so that is why they are allowable expenses for the current grant year. Since the hotel charges you upon checkout that would not be considered this year’s expenses. The goal is for cost savings so buying early on conferences and airfare is appropriate. If programs have specific requests they should send them through individually to their Family Support Consultant.

Budgeting

Note: Do not use the ARP Categories unless directed when entering budgets as those are reserved for specific uses.

Budget Expenditures

Budget Revisions

| 277 downloads | 1.0 | 09-09-2022 14:06 | Download |

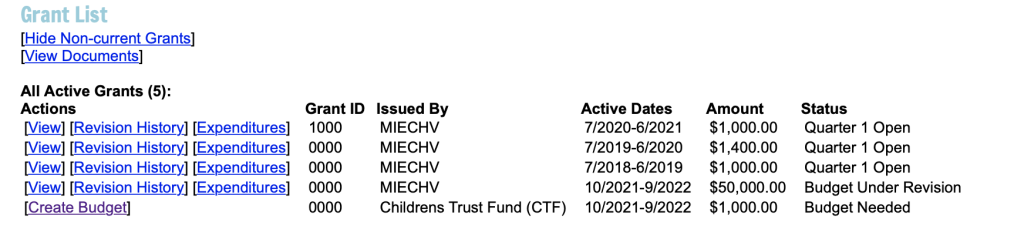

Grant View Screen

Please note when logging in the system will now only display the active grants for this current fiscal year (either July to June or October to September depending on your grant award(s)).

If you need to view prior or future year grants you will need to select View all Grants under the Grant List Header.

Example

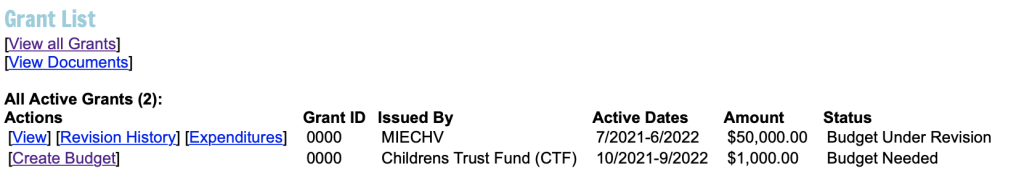

After selecting View all Grants the page will refresh and display all current, future, and prior grants.

Example

If you would like to hide the non-current grants you can select the option after viewing all.

Example

Deminimus Rate Calculation Worksheet

| 340 downloads | 1.0 | 06-09-2022 17:50 | Download |

Audits

Audit Clauses

For all Family Support and Family Center grants which began on July 1st, 2022 the individual documents Audit Clause A (non-profit) or Audit Clause B (for-profit) included as a part of the Grantee Agreements have been replaced by a singular document which contains both clauses labeled as Standard Audit Clauses, Audit Clause A-B. The updated audit clause document can be downloaded below.

| 282 downloads | 1.0 | 06-08-2023 14:58 | Download |

Audit Request

As of July 1, 2023, Audit Confirmation reports will be requested by the vendor via the vendor self- managed service accessed through the https://www.bpp.ob.pa.gov/ website requiring a Keystone Log On. The service will be available 24/7. For vendor account security and fraud protection, the self-managed audit confirmation service will email the audit in .pdf version directly to the Certified Public Accountant firm as provided by the vendor contact.

The vendor contact will register for a Keystone Log In. After the registration is completed, the vendor contact will access the Audit Confirmation page, input the type of report (Total Expenditures or SUBS), input the beginning and ending dates, and input the email address of the CPA the vendor is working with. The report will generate automatically. The report will be sent in .pdf version to the email address of the CPA firm as provided by the vendor contact.

If you have any questions concerning the paperless confirmation process, please email the Audit resource account: RA-AuditConfirmation@pa.gov.

Keystone Login

The vendor or an appropriate employee designee from the vendor organization (i.e. vendor contact) registers for a Keystone Login. After the Keystone Login registration is completed, the vendor contact will access the Audit Confirmation page, input the type of report (Total Expenditures or SUBS), input the beginning and ending dates, and input the email address of the CPA the vendor is working with. The automatically generated report will be emailed in .pdf version to the CPA firm email address as provided by the vendor contact.

To get started, click the link below to the Audit Confirmation Registration Guide, showing step-by-step instructions for:

1. Keystone Login Registration

2. Logging into the OB Business Partner Portal to request Audit Confirmation

3. Audit Confirmation Report Data & Navigation

Instructions for how vendors can use the new service can be found at the website below.

OB Business Partner Portal Audit Confirmation Registration Guide and Reports Creation

How to View your Payments from

the Pennsylvania Treasury

Please visit the the OB Business Partner Portal – Vendor Services https://www.bpp.ob.pa.gov for access to the Self-Service Lookup reports.

The invoice status self-service tool displays the most recent 60 days of information pertaining to:

- Invoices In Process

- Invoice Payments

Keystone Login is Required

Each individual user is required to register through the Keystone Login registry to access the reports. See the User Guide for Keystone Login registry Instructions and related FAQ’s.

Self-Service Payment Lookup Link

https://www.budget.pa.gov/Services/ForVendors/Pages/Self-Service-Payment-Lookup.aspx

Not Registered For Keystone Login?

Visit the KEYSTONE LOGIN page to register.

FISCAL FAQ’s

Managing Multiple Funding Sources to Support Programs

Braided vs. Blended

It is important for Grantees who are receiving federal funding to understand when it is acceptable to use multiple funding streams, and in what ways. The first step in this process is to understand the difference between braided and blended funds.

- Braided funds are funds from multiple funding streams that are leveraged (i.e., woven together) to support high quality programs.

- Blended funds are funds from one funding source that are commingled with funds from another source (i.e., all put into one pot, where the original funding sources become indistinguishable).

Federal funding allows Grantees to braid funds but prohibits the blending of funds. The table below presents the rationale for this decision and reference guidance.

Braided vs. Blended Funding At-a-Glance

| TYPE | DESCRIPTION | ALLOWED? | RATIONALE | REFERENCE GUIDANCE/ REQUIREMENTS |

| Braided | Leveraged use of multiple funding streams | Yes, where there are natural opportunities for strengthening programs | This method is allowed because: •The specific funding sources can be traced• The inflows and outflows of each funding source with specific funding requirements can be tracked | 45 CFR §75.302(b), Financial management and standards for financial management systems |

| Blended | Co-mingling funds from more than one source | No, federal funding prohibits blending | This method is prohibited because: •Blended funds are co-mingled with other funds, so individual funding streams cannot be traced to the funding source | 45 CFR §75.302(b), Financial management and standards for financial management systems |

Tips for Implementing a Braided Model

Establish clear objectives. Clearly define the rationale for using multiple funding sources, including what you plan to achieve under individual funding sources and for the “braided” project, overall. For example, do you hope to reach more families? Do you wish to implement a new program model so that families have the best model to fit their needs? Are you focused on long term sustainability of home visiting services? Having a clearer understanding of your objectives can guide more informed decision making.

Engage stakeholders. It is best practice to engage key stakeholders, including parent leaders, early on as you define how to maximize the benefits of braided funding. Enlist the support of senior management in the process. Make sure they have a clear picture of the risks versus the benefits of using braided funding and include them as you design your funding to mitigate risks.

Assess funding opportunities in relation to programmatic services. As you identify and explore funding sources that allow braiding, envision the program work in a braided environment. Will you build out

a continuum of services and use multiple home visiting program models to meet the differing needs of families? Will you concentrate on expanding the number of families receiving home visiting using an existing program model? Or might you use a funding stream to enhance a current model or implement an innovative practice? Determine how you will match activities and outcomes with funding streams. Consider the requirements for reporting braided and individual fiscal and programmatic data as you design your funding plan, and build in additional reporting capacity and infrastructure as needed.

Develop a coordinated funding plan. Key questions to explore for each source of funds in a coordinated plan include the following:

- Flexibility: How flexible and receptive are the funding sources to “braiding”? Does the funding source permit braiding? Does it encourage braiding? Are there examples of successful home visiting providers currently using a braided approach with the funding source and federal funding?

- Durability: What is the durability of the various funding resources? Are they time limited or recurring (durable)? For example, American Recovery Act (ARP) funds currently available to address COVID-19-related needs may not be recurring. By comparison, Medicaid tends to be an ongoing and stable source of funding. What is the best way to move forward, given either time-limited or durable funding?

- Alignment: Are the funding streams closely aligned with the performance periods to minimize administrative disruptions?

- Restrictions: What limitations are included in the funding terms and conditions for each funding source from both a fiscal and programmatic standpoint? For example, Families First Prevention Services Act funding allows up to 12 months of services per family. However, MIECHV program model fidelity may require that home visiting services be offered to families for more than 12 months. So, are there options or opportunities to design program services and funding to accommodate all funding terms and conditions?

Assess your financial management strengths and gaps.

These include the following:

- Accounting system capacity: Does your accounting system have the capacity to track individual funding sources and combine multiple funding to meet tracking, accountability, and reporting requirements? (See 45 CFR §75.302 for more information.)

- Time and effort documentation: Have staff members been thoroughly trained on the requirements for

time and effort tracking and for adequate source documentation to meet multiple funders’ requirements? Have you developed training materials that can be shared with auditors and funders? (See 45 CFR §75.303 and §75.430 for more information.) - Infrastructure for increased fiscal monitoring: Do you have enough trained personnel (both internally and among external partners) to address the increased risk of non-compliance that may accompany a more complicated funding approach? Can your accounting system accommodate the heightened monitoring requirements without having to rely on multiple manual processes? Have you prepared your partners and auditors for this change and addressed their concerns? (See 45 CFR §75.303 for more information.)

- Policy and protocols: Have you updated your policy and process documentation? Have you communicated policy and protocol changes and trained both staff members and partners? (See 45 CFR §75.302(b)(7) and §75.303 for more information.)

- Allocation methodology: Have you scheduled periodic reviews of your allocation methodology at key milestones, such as after implementation for process improvements, both prior to your Single Audit for organizational clarity and after your audit for lessons learned? (See 45 CFR §75.403–405 for more information.)

Determine roles and responsibilities, particularly in these key areas:

- Budgeting: Who will develop and refine an accepted allocation methodology for the “braided” budget? Who will manage fund-specific budgeting and consolidate an overall funding view into a budget “roll-up”? (See 45 CFR §75.405 for more information.)

- Tracking: Who will develop and refine processes for tracking funding inflows and outflows? Who will review and create tracking accounts and cost centers? Who will create budget vs. actual reporting for fund-specific reporting and budget roll-ups of braided funds? (See 45 CFR §75.302 (b)(3)-(7) for more information.)

- Cost allocation plans: Who will identify the impact on your negotiated indirect cost rate agreement (NICRA) or public assistance cost allocation plan (PACAP)? Who will communicate with cognizant agencies, auditors, and other required stakeholders about these agreements and plans? Who will monitor cost allocation to ensure compliance with allocation methodology? (See 45 CFR §75.416–419 for more information.)

- Communication: Who will lead communication between fiscal and programmatic staff on requirements for implementation, tracking, training, reporting, and monitoring? Who will be included in a visible leadership group for staff members and stakeholders to contact as issues arise and as revisions are needed?

- Monitoring: Who will identify the areas that require additional oversight for compliance? Who will monitor the areas of highest risk of non-compliance, such as payment management, cost allowability, and procurement? Who will train staff on effective monitoring techniques consistent with individual funding requirements and the complexity of “braided” funding models? (See 45 CFR §75.305 and §75.309; §75.403; and §75.327—329 for more information.)

- Training: Who will train staff on funder requirements, internal processes, and monitoring for compliance? Who will lead process improvements both prior to your Single Audit for organizational clarity and after your audit for lessons learned?

- Ongoing review: Who will plan for the regular review of changing needs and resource gaps with management? Who will create and manage a feedback process to identify roadblocks in real-time so that staff and partners are empowered to address issues quickly?

Conclusion

Multiple funding sources can expand services to reach more families. However, these expanded opportunities come with increased management complexity. Federal award recipients should have a clear understanding of the challenges and benefits of incorporating multiple funding sources into their program in order to minimize potential non-compliance and avoid disallowed costs. However, with careful planning, adherence to fiscal regulations, and sound financial management, the use of multiple funding streams can bean exciting opportunity to expand and improve services for families with young children who can benefit from them.

Fiscal Monitoring

Family Support and Family Center Programs are required to adhere to the terms and conditions of their contractual grant agreement with the Office of Child Development & Early Learning, OCDEL. As part of the contract, OCDEL provides assurances that the programs remain in compliance with state and federal program and fiscal requirements. Programs must at a minimum follow their own organizational policies related to generally accepted accounting procedures OR create an approved policy. This page serves as a template for the mentioned policies.

| 315 downloads | 1.0 | 09-06-2022 8:28 | Download |

Fiscal Policies and Procedures

Fiscal Procurement Policy

Ethical behavior in purchasing: Unethical actions, or the appearance of unethical actions, are unacceptable under any conditions.

Each employee must apply her/his own sense of personal ethics, which should extend beyond compliance with applicable laws and regulations in business situations, to govern behavior where no existing regulation provides a guideline. Each employee is responsible for applying common sense in business decisions where specific rules do not provide all the answers.

In determining compliance with this standard in specific situations, employees should ask themselves the following questions:

- Is my action legal?

- Is my action ethical?

- Does my action comply with agency policy?

- Am I sure my action does not appear inappropriate?

- Am I sure that I would not be embarrassed or compromised if my action became known within the agency or publicly?

- Am I sure that my action meets my personal code of ethics and behavior?

- Would I feel comfortable defending my actions on the 6 o’clock news?

Each employee should be able to answer “yes” to all of these questions before taking action. Each director, manager and supervisor is responsible for the ethical business behavior of her/his subordinates. Directors, managers and supervisors must carefully weigh all courses of action suggested in ethical, as well as economic terms, and base their final decisions on the guidelines provided by this policy, as well as their personal sense of right and wrong.

Fiscal Purchasing Process Policy

- Grantees must seek the best value in purchasing supplies in support of program services.

- Grantees should compare prices for materials and supplies from vendors and select the vendor with the best value

- For single item purchases in excess of $5,000.00, documentation of comparison should bemaintained.

- Grantees must maintain invoices and receipts as part of their fiscal records.

Fiscal Inventory Policy

OCDEL Family Support grantees must maintain an Inventory of all equipment with a single purchase price of $5,000 or greater. Inventory documentation should include:

- Item name,

- Initial Purchase price,

- Date of purchase, and

- Annual Description of condition (such as excellent, good, fair, poor).

Fiscal Security and Storage of Data Policy

- Grantees maintain data in a secure, fire-protected environment.

- Access to files shall be limited to individuals authorized by management.

- A log should be kept which records the whereabouts of each record.

- Back-up documentation is recommended.

Fiscal Conflict of Interest Policy

In the course of business, situations may arise in which an organization decision-maker has a conflict of interest, or in which the process of making a decision may create an appearance of a conflict of interest.

All employees have an obligation to:

- Avoid conflicts of interest, or the appearance of conflicts, between their personal interests and those of the Organization in dealing with outside entities or individuals,

- Disclose real and apparent conflicts of interest to the OCDEL, and

- Refrain from participation in any decisions on matters that involve a real conflict of interest or the appearance of a conflict.

Fiscal Record Retention and Destruction Policy

OCDEL Family Support grantees are expected to maintain all program and fiscal records after the close of the program year for 7 years. Grantees should develop a policy addressing:

- File storage;

- Method of identifying records for destruction

- Method of destruction.

Fiscal Proof of Insurances

OCDEL Family Support grantees must maintain general liability and shall carry reasonable amounts of accident insurance, liability insurance for accidents of their premises, and transportation liability insurance.

Fiscal Cost Allocation Plan

Since most organizations operate many different programs, please provide us with a copy of your cost allocation plan that indicates how certain costs, for example, salaries, rent, utilities, etc. are prorated amongst these programs.

- If a plan does not exist, grantees are encouraged to work with their accountant or fiscal department to establish a cost allocation plan for allowable costs that fairly and reasonably apportions costs.

- The following are some examples of how cost allocation methodologies can be applied by costcategories:

| COSTS | BASIS |

| Personnel Costs | Time |

| Personnel Costs (mixed Programs) | Number of Families |

| Space and Utilities | Square Footage & Time |

| Instructional Supplies | Number of Families/Personnel |