Fiscal Frequently Asked Questions

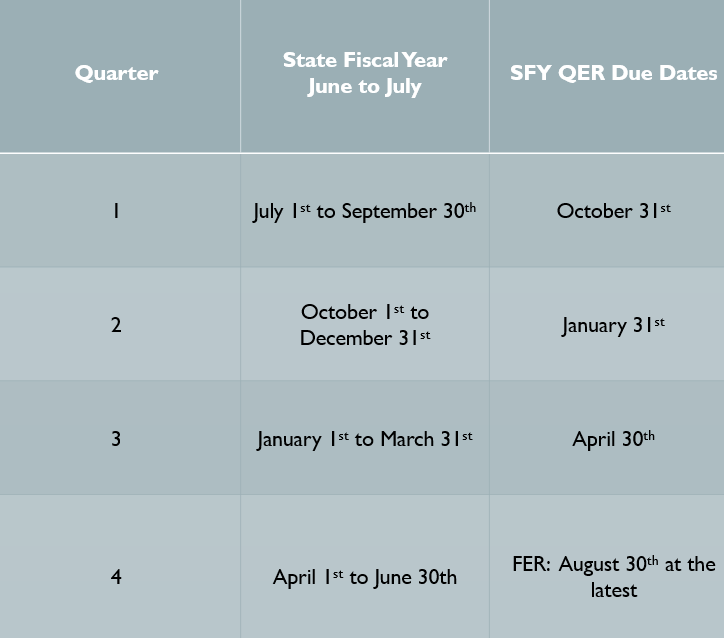

How to spend down funds with incentives/stipends? a. Parent incentives may be allowable if tied to parent engagement and is Could we use funds to send home visitors to the National Conference in future grant years? a. Generally, Airfare and Conference Registration charge immediately so that is How do I view my grant screen? a. Logging into the data system – Please note when logging in the system will How do I submit an audit request? a. As of July 1, 2023, Audit Confirmation reports will be requested by the vendor How do I have access to my Keystone login? a. The vendor or appropriate employee designee from the vendor organization How do I view my payments from the Pennsylvania Treasury? a. Please visit the OB Business Partner Portal – Vendor Could you explain Braided vs. Blended funding? a. It is important for Grantees who are receiving federal funding to understand How do I enter my quarterly expense report (QER) and when do I submit them? a. You will submit the QER every quarter, see the dates below: b. All quarterly expense reports will be entered into the data system using this How do I submit my Final Expenditure report (FER) and when do I submit that? a. Once the year has closed (after June 30th), you will then begin to close your What are the current reporting/approval thresholds for supplies and equipment? a. Equipment and Supplies: less than $10,000 How do I calculate my De Minimus rate? a. There is a calculator spreadsheet ready to download on the website How do I access the data system? a. https://data.pa-home-visiting.org/user/login I am a new user to the data system, how do I get set up? a. Please email cking@pattan.net to help get you set up, we will need to get you What are some commonly used acronyms? a. SFY: State Fiscal Year (July 1st – June 30th) Who can I contact for more information? a. For audits, payments, support: ra-pwpahomevisiting@pa.gov

How to spend down funds with incentives/stipends?

meaningful to the operation and implementation of the grant approved

model.

b. Stipends are only to be considered if you have an organizational policy that

lays out the method and purpose for providing a stipend. Typically, they are

provided when a staff person is required to go above and beyond their normal

hired duties.

Could we use funds to send home visitors to the National Conference in future grant years?

why they are allowable expenses for the current grant year.

b. The hotel charges you upon checkout that would not be considered this

year’s expenses. The goal is for cost savings so buying early on conferences

and airfare is appropriate.

How do I view my grant screen?

now only display the active grants for this current fiscal year (either July to

June or October to September depending on your grant award(s).

b. If you need to view prior or future year grants you will need to select View, all

Grants under the Grant List Header. After selecting View all Grants the page will refresh and display all

current, future, and prior grants.

How do I submit an audit request?

via the vendor self- managed service accessed through the

https://www.bpp.ob.pa.gov/ website requiring a Keystone Log On. The

service will be available 24/7. For vendor account security and fraud

protection, the self-managed audit confirmation service will email the audit

in .pdf version directly to the Certified Public Accountant firm as provided by

the vendor contact.

b. The vendor contact will register for a Keystone Log In. After the registration is

completed, the vendor contact will access the Audit Confirmation page,

input the type of report (Total Expenditures or SUBS), input the beginning and

ending dates, and input the email address of the CPA the vendor is working

with. The report will generate automatically. The report will be sent in .pdf

version to the email address of the CPA firm as provided by the vendor

contact.

c. If you have any questions concerning the paperless confirmation process,

please email the Audit resource account: RA-AuditConfirmation@pa.gov.

How do I have access to my Keystone login?

(i.e. vendor contact) registers for a Keystone Login. After the Keystone Login

registration is completed, the vendor contact will access the Audit

Confirmation page, input the type of report (Total Expenditures or SUBS),

input the beginning and ending dates, and input the email address of the CPA

the vendor is working with. The automatically generated report will be

emailed in .pdf version to the CPA firm email address as provided by the

vendor contact.

b. To get started, click the link below to the Audit Confirmation Registration

Guide, showing step-by-step instructions for:

i. Keystone Login Registration

ii. Logging into the OB Business Partner Portal to request Audit

Confirmation

iii. Audit Confirmation Report Data & Navigation

iv. https://www.pa.gov/search#q=business-partner-portal-registrationand-audit-confirmation.pdf

How do I view my payments from the Pennsylvania Treasury?

Services https://www.bpp.ob.pa.gov for access to the Self-Service Lookup

reports.

b. The invoice status self-service tool displays the most recent 60 days of

information pertaining to:

i. Invoices In Process

ii. Invoice Payments

c. Keystone Login is Required

Each individual user is required to register through the Keystone Login

registry to access the reports. See the User Guide for Keystone Login

registry Instructions and related FAQ’s.

d. Self-Service Payment Lookup Link

https://www.budget.pa.gov/Services/ForVendors/Pages/Self-ServicePayment-Lookup.aspx

e. Not Registered for Keystone Login?

Visit the KEYSTONE LOGIN page to register. https://www.bpp.ob.pa.gov/

Could you explain Braided vs. Blended funding?

when it is acceptable to use multiple funding streams, and in what ways. The

first step in this process is to understand the diƯerence between braided and

blended funds.

b. Braided funds are funds from multiple funding streams that are leveraged

(i.e., woven together) to support high quality programs.

c. Blended funds are funds from one funding source that are commingled with

funds from another source (i.e., all put into one pot, where the original

funding sources become indistinguishable).

d. Federal funding allows Grantees to braid funds but prohibits the blending

of funds. The table below presents the rationale for this decision and

reference guidance.TYPE DESCRIPTION ALLOWED? RATIONALE REFERENCE GUIDANCE/ REQUIREMENTS Braided Leveraged use of multiple funding streams Yes, where there are natural opportunities for strengthening programs This method is allowed because:

•The specific funding sources can be traced• The inflows and outflows of each funding source with specific funding requirements can be tracked45 CFR §75.302(b), Financial management and standards for financial management systems Blended Co-mingling funds from more than one source No, federal funding prohibits blending This method is prohibited because:

•Blended funds are co-mingled with other funds, so individual funding streams cannot be traced to the funding source45 CFR §75.302(b), Financial management and standards for financial management systems

How do I enter my QER and when do I submit them?

link: https://data.pa-home-visiting.org/user/login

i. If you do not have a login, please reach out to cking@pattan.net to get

this set up for you.

c. You will then click on the expenditure for that grant and enter them based off

which quarter you are reporting on.

d. Please make sure to include any notes as to why you are underspent for the

quarter based oƯ the following information:

i. Q1 – 25%

ii. Q2 – 50%

iii. Q3 – 75%

iv. Q4 – 100%

v. A reasoning is needed if you are underspent so we can understand

how you plan on spending the funds in the upcoming months. Any

additional information on the program and the expenses will help

when reviewing the QER.

How do I submit my FER and when do I submit that?

books internally. Once you do that you will be able to submit your final

expenditure report in the data system, the same way you submit a QER.

b. All FERs are due before August 30th at the latest.

c. Please include a note as to why you may be underspent for the year

i. Example: 94% spent for the year because we did not fulfill all of the

anticipated program salaried positions.

What are the current reporting/approval thresholds for supplies and equipment?

How do I calculate my De Minimus rate?

b. The spreadsheet will walk you through how to calculate the amount needed

c. The current rate is 15%

How do I access the data system?

I am a new user to the data system, how do I get set up?

a login, but you will need to create your own password. From there we will be

able to get you logged into the data system

What are some commonly used acronyms?

b. FFY: Federal Fiscal Year (October 1st– September 30th

c. QER: Quarterly Expenditure Report

d. FER: Final Expenditure Report

e. Budget: OƯicial approved document in Family Support Data Collection

System

f. Budget Revision: Net zero budget change If a New/Major Line-Item change

+/- 10%

g. Funding Adjustment: Changing overall funded amount

Who can I contact for more information?

b. You can also contact your fiscal support: cking@pattan.net

c. You can also contact your consultant:

Ashley Ankeny – AAnkeny@pattan.net

Heather Powell – HPowell@pattan.net

Ilecia Voughs – IVoughs@pattan.net